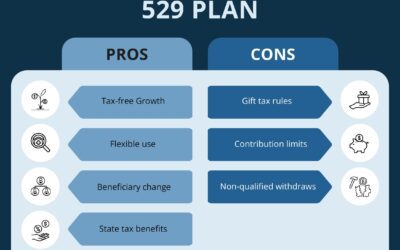

529 Plan, Bring On Tax Savings

By Noah Styles, CPA Jason is an expert welder. Matthew is the plumber you need to call. You need a CPA like Hannah. What do these people have in common? They all are educated professionals in their respective fields. If there is a child...

Complying with SECURE Act Changes to Long-Term Part-Time Employee Eligibility and IRS Form 5500

Are your retirement plans Compliant? Do you know about the new retirement plan rules for part-time employees and changes to Form 5500 that affect compliance and audits? Read the full article by clicking on the link in the comment section.

The Benefits of a Mid-Year Tax Review for Your Business

Conducting a mid-year tax review is beneficial for efficient tax management and fiscal health, helping businesses identify tax-saving opportunities, correct errors, update financial forecasts, manage cash flow, and stay compliant with changing regulations. Don’t wait—get ahead with a mid-year tax review for proactive tax planning and financial success.

Quality of Earnings Analysis Tells the Story Behind a Company’s Numbers

Understanding the true financial health of a business goes beyond the numbers on a balance sheet. A Quality of Earnings (QoE) analysis delves into the underlying factors driving a company’s earnings, offering crucial insights for mergers, acquisitions, and strategic planning. Discover how a QoE report can provide a clearer picture of sustainable earnings and inform key business decisions.

State Pass-through Entity Taxes Offer Significant Tax-saving Strategy for Businesses

The Rules Vary from State to State Benjamin Buckner | Tax Manager Pass-through entity tax elections have become a significant strategy in most U.S. states to mitigate the impact of the $10,000 cap on deductions of state and local taxes (SALT) on federal income tax...

Guidance from DOL and IRS Slow in Coming for SECURE 2.0 Act

Terri Roughton, QKA, CEBS | Pension Specialist The “SECURE 2.0” legislation that was signed into law in late 2022 makes significant changes to workplace retirement plans, and many plan sponsors will have to amend their plan documents in order to take advantage of...

Protecting Your Business: IRS Halts Employee Retention Credit Processing Amid Scam Concerns

In a move to help safeguard small business owners from potential scams and fraud, the Internal Revenue Service (IRS) recently announced a moratorium on processing new claims for the Employee Retention Credit (ERC) through at least the end of the year. This decision...

How Will You be Affected by Proposition 12?

Jacquelyn Babcock, DirectorFACTA LLCAnimal Welfare, Assurance, Certification and Training Since its passage by voters in 2018, California’s Proposition 12 has clouded the skies for pork, veal and egg producers like a distant storm – threatening, but far enough away to...

Executive Order to Extend the Arkansas State Individual Tax Filing Deadline for Select Counties

We send our sincerest thoughts and well-wishes to all those affected by the devastating tornados that swept through Arkansas last Friday, March 31, 2023. As we navigate these uncertain times, it is our hope that all those affected by the current crisis can recover...

House Passes Bipartisan Infrastructure Bill

The U.S. House of Representatives in the late hours of Friday, November 5, 2021,passed H.R. 3684, the “Infrastructure Investment and Jobs Act” in a 228 to 206bipartisan vote. The Senate had approved the same version of the bill, which isnow ready for the president’s...

FACTA ANNOUNCES NEW DIRECTOR

Farm Animal Care Training and Auditing (FACTA) today has announced a new Director, Jacquelyn Babcock to lead the growing animal welfare and audit group. Jacquelyn Babcock was born and raised in southwest Michigan on a small family farm. Her family has a long history...

FROST, PLLC ANNOUNCES ADDITION OF THREE PARTNERS

Lindsey Jackson, Douglass Snell & Curtis Winar Voted into Membership Roles Frost, PLLC is pleased to announce the addition of three new partners: Lindsey Jackson, Douglass Snell, and Curtis Winar. Lindsey Jackson, CPA, has been with Frost since 2009 and has over...

IRS ANNOUNCES INDIVIDUAL FEDERAL TAX DEADLINE EXTENDED TO MAY 17TH, 2021

On March 17, 2021, The Treasury Department and Internal Revenue Service (IRS) announced that the federal income tax filing and payment due date for individuals for the 2020 tax year will be extended from April 15, 2021, to May 17, 2021. We expect the IRS will be...

Welcome to Our Yuma Office

Author: Eric Chastaine | Business Development Director So we all know that we have an office in Yuma, but what do we know about Yuma itself? The first Europeans to arrive in Yuma did so clear back in 1540, approximately 80 years before the pilgrims arrived at...

Congress’ COVID Relief Package

Author: Lindsey Jackson, CPA Sunday afternoon Congress reached an agreement for the next round of COVID relief. While the text of the bill has yet to be released, the anticipated legislation is expected to include a few favorable tax provisions as well as updates to...

Could a Health Savings Account be Right for You?

By Noah Styles, CPA According to a 2018 America’s Health Insurance Plan article,[1] 22 million Americans have a Health Savings Account (HSA). Why so many? Well, HSAs have a unique triple tax incentive. If you are like the average person, when you...

College is Expensive. Are You Ready?

By Noah Styles, CPA Do your kids plan on attending college? According to a 2019 Bureau of Labor Statistics article[1], 66% of high school graduates in the United States enrolled in college. With so many high school graduates starting college, a question...

Employee Payroll Tax Deferral – Guidance Provided by IRS Notice 2020-65

Author: Lindsey Jackson, CPA The Internal Revenue Service issued guidance regarding the employee payroll tax deferral described in the Presidential memorandum from August 8th. IRS Notice 2020-65 provides details to employers who are considering taking advantage of the...

Initial PPP Loan Forgiveness FAQ Released

Author: Lindsey Jackson On Tuesday, August 4th, the SBA released an FAQ specifically related to the PPP loan forgiveness process. A copy of the full document may be found here. Similar to the FAQs for the initial application, we anticipate that over the coming...

PPP Loan Application Extended

Author: Lindsey Jackson, CPA An extension to the loan application window for the Paycheck Protection Program (PPP) moved through the Senate, and after a unanimous vote in the House yesterday, is headed to the White House for signature. The extension will keep the...